(Another attempt at humour. It seems like everyone wants to take away your happiness, so it's always good to grab a few cheap laughs when you can.)

Introduction: Why This Report Matters to You

If you’ve been house hunting, thinking about building, or just trying to make sense of why everything feels so expensive right now — you’re not imagining it. The numbers are in, and they tell a pretty clear story.

Every year, the Urban Development Institute of Australia (UDIA) releases what they call the State of the Land report. Sounds a bit dry, sure — but behind the charts and tables is something that hits home for all of us: just how hard it’s become to build or buy a place to live in Australia.

This year’s report, released in March 2025, is basically a health check on Australia’s housing market. It’s not a bunch of guesses either. It’s backed by real data from CoreLogic, Research4, Charter Keck Cramer, and a nationwide survey of what’s happening in our biggest cities.

Here’s what the report tells us: despite all the talk about solving the housing crisis, we’re falling further behind. Lot releases are up in some areas, but nowhere near enough. Apartment construction? Still in the dumps. And that much-hyped target of 1.2 million new homes by 2029? At this rate, we’ll miss it by nearly 400,000.

Whether you’re planning to build your first home, buy off-the-plan, or just want to understand why prices and rents won’t stop rising, this article breaks it all down for you — without the jargon.

We’ve combed through the report so you don’t have to. Stick around as we walk through what’s really going on with land supply, lot sizes, unit prices, and why so many builders are folding. There’s no sugar-coating here, but we’ll explain what it means and what you can do about it.

The Big Picture: Australia’s Housing Shortfall Is Real — and Growing

Let’s start with the elephant in the room: Australia doesn’t have enough homes.

The Federal Government set a big, bold goal — 1.2 million new homes by 2029. It sounds ambitious because it is. But according to the State of the Land 2025 report, we’re going to fall short. By a lot.

How short?

Try 393,000 homes.

That’s nearly 400,000 homes we won’t build in time. And no, that’s not a guess. The UDIA looked at current construction trends, approvals, completions, and market capacity — and the numbers just don’t add up.

What’s behind the shortfall? A few key things:

- Multi-unit developments (like apartments and townhouses) are way down. Construction has stalled thanks to rising building costs, labour shortages, and project delays.

- Greenfield land supply (that’s new land released for housing on the city fringes) is better — but still not fast or big enough to keep up.

- Feasibility is broken. Developers can’t get projects off the ground because the numbers don’t work. Construction is more expensive, but buyers can’t afford to pay more. It’s a deadlock.

Meanwhile, Australia’s population is growing fast. Net overseas migration hit 552,000 last year — nearly double the long-term average. But the number of new homes built didn’t keep pace. Not even close.

This mismatch means more people are competing for fewer homes. That pushes prices up, makes rentals harder to find, and squeezes affordability for just about everyone.

And here’s the catch: even if we somehow boosted construction tomorrow, the system isn’t ready to deliver at that scale. Approvals take too long. Infrastructure isn’t keeping up. And the skilled labour simply isn’t there.

In other words, the housing shortfall isn’t just about demand. It’s about capacity. We can’t build fast enough, even if we wanted to.

Greenfield vs. Multi-Unit: The Tale of Two Markets

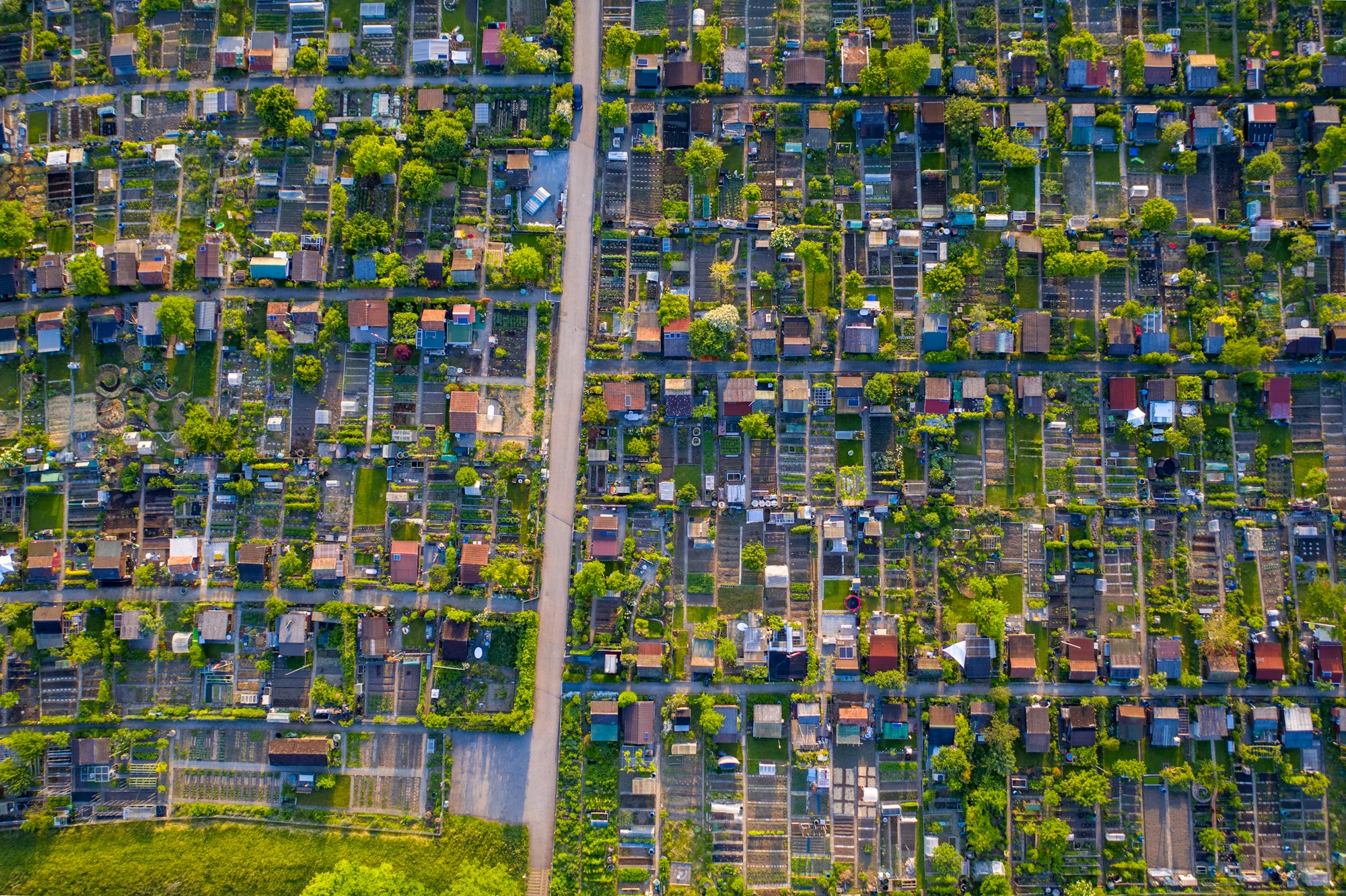

When we talk about new housing supply, it really falls into two buckets:

Greenfield (think: new suburbs on the edge of town), and multi-unit (apartments, townhouses, and anything medium to high density in existing urban areas).

Here’s the thing: only one of those markets is doing okay — and even that’s a stretch.

Greenfield: Trying to Bounce Back

There’s been a bit of a rebound in greenfield land sales. In 2024, around 42,700 new lots were released, which is a 15% jump from 2023. Sounds promising, right?

Well, yes and no.

It’s still 20% below the long-term average, and 46% lower than the peak in 2021. So, we’re bouncing back from a low base. Sales are stronger in places like Perth and SEQ (South East Queensland), but other markets like Melbourne and Adelaide are still lagging. In the ACT, the greenfield market is practically on life support — sales dropped to just 272 lots for the whole year.

Developers are also releasing smaller lots. The national average lot size is now just 411 square metres, down 0.7% from last year. That’s the smallest it’s been in 15 years.

Prices? They’re up almost everywhere. Sydney reclaimed its title as the most expensive greenfield land in the country with a median price of $666,670 per lot. Perth, interestingly, had the biggest jump in price — up 34% — as east coast investors snapped up whatever was left. SEQ also saw a solid 11.5% rise.

Multi-Unit: Stuck in a Slump

If greenfield is hanging in there, the apartment market is still on the mat.

- Sales of new apartments and townhouses dropped another 8% in 2024, now sitting more than 50% below the decade average.

- Multi-unit completions were 21% lower than the long-term average — and 40% lower than their 2017 peak.

- Build-to-sell (BTS) apartments — the backbone of unit development — have collapsed, with completions dropping 45% since 2016.

Why? Developers can’t make the numbers work. Construction costs are too high, approvals take too long, and interest rates make buyers (and lenders) nervous.

Even promising sectors like Build-to-Rent (BTR) are struggling to get off the ground, despite a five fold increase in completions last year. It’s still nowhere near enough to make up for the collapse in BTS.

The result? Cities are missing out on new homes that could be built closer to jobs, schools, and public transport.

So what does this mean?

Basically, greenfield land is the only part of the new housing market that’s still ticking along. It’s not booming — but it’s functioning. Meanwhile, multi-unit housing, which is supposed to deliver more affordable, diverse, and inner-city living, is grinding to a halt.

And when one half of the market collapses, the other can’t pick up the slack.

Land Prices: Up Almost Everywhere, Fastest in WA & SEQ

If you’re hoping land prices might come down soon… sorry to say, they’re still heading in the other direction — and fast in some places.

The 2025 State of the Land report shows that land prices across Australia’s capital cities jumped 8% on average in 2024, reaching $1,116 per square metre. That’s the national average — but the reality on the ground depends entirely on where you’re looking.

Where Prices Jumped the Most

Let’s start with the front runners:

- Perth: A massive 34% increase in median lot prices — the biggest jump recorded in over 15 years. Median lot price hit $329,000, and land price per square metre shot up to $877/sqm.

- South East Queensland: Lot prices climbed 11.5%, breaking the $400k barrier for the first time ever. Land now costs $992/sqm on average.

- Adelaide: Up 19% to $307,250 per lot — still the most affordable capital city market in dollar terms, but no longer cheap in a relative sense.

Even Sydney, already the most expensive land market in the country, saw prices rise 4% in 2024. Its median lot price is now $666,670, and the price per square metre sits at a jaw-dropping $1,617.

Any Relief Anywhere?

Only two places saw land prices fall in 2024:

- ACT: Prices dropped 4%, but at $651,750 per lot, land in Canberra is still the second most expensive in the country.

- Melbourne: A very small 0.2% dip in land price per square metre, with median lot prices up just 2.1% — holding steady at around $403,000.

It’s worth noting that Melbourne is still selling the smallest lots in the country (median size: 361sqm) — so while the sticker price might look better, you’re getting less dirt for your dollar.

What’s Driving These Increases?

Simple supply and demand. In most cities, available stock is tight — and what’s left is being sold quickly. Combine that with high landholding costs for developers, a slow planning system, and lack of new estates coming online, and the pressure builds.

Even when consumer demand is shaky (thanks to interest rates and cost-of-living pressures), land prices are still climbing — because the pipeline isn’t refilling fast enough.

What this Means for Buyers

If you’re trying to buy land, the trends are clear:

- You’ll be paying more per square metre almost everywhere.

- You’ll likely end up with a smaller block.

- And unless something changes, this won’t reverse anytime soon.

What’s Really Holding Housing Back: Six Key Constraints

If you’ve ever wondered why we can’t just build more houses, faster — you’re not alone. On paper, it seems simple: more people need homes, so build more homes. But in reality? The construction industry is hitting roadblocks from every angle.

The State of the Land 2025 report highlights six major constraints slowing everything down. None of them are new, but together, they’re making a perfect storm.

1. Population Growth Is Outpacing Housing Supply

Australia added almost 700,000 new people last year — mostly through migration — but we didn’t build nearly enough homes to match. This is pushing up demand, tightening the rental market, and leaving many new arrivals scrambling for housing.

2. Construction Costs Are Still High

The price of materials and labour has skyrocketed over the last few years. Even though it’s stabilising a bit, it hasn’t gone down — and there’s no real relief in sight. For developers, this means many projects just don’t stack up financially anymore.

3. Labour Shortages Are Biting Hard

Australia lost around 3,000 builders in FY24, and many others are hanging on by a thread. There simply aren’t enough skilled tradespeople to meet demand. Electricians, carpenters, bricklayers, tilers — you name it, we’re short on it. Training new workers takes time, and migration isn’t filling the gap fast enough.

4. The Development Pipeline Has Collapsed

The report shows a 44% drop in medium and high-density unit construction since 2016. That’s a massive hole in supply.

Projects are being shelved before they even break ground. It’s not just about cost — it’s also about uncertainty, delays in approvals, and financing constraints.

5. Planning and Approvals Are Slow and Complicated

State and local governments have been promising to “cut red tape” for years, but approval times remain slow. Infrastructure planning is fragmented, and zoning reforms move at a snail’s pace. Some councils are still fighting developments that meet their own planning rules.

6. Financing Is Getting Harder

Higher interest rates have made borrowing harder for both developers and home buyers. Banks are stricter. Pre-sales are harder to secure. Even good projects struggle to find the capital to move ahead. No money, no homes.

It's Not Just Demand — It’s Delivery

Yes, there’s strong demand. But it’s the delivery system that’s broken. Even if buyer demand holds up, we simply can’t build fast enough without serious reforms to the way land is released, approved, financed, and constructed.

And remember: this isn’t just a problem for big developers or government. It affects anyone trying to build, including regular homeowners doing knockdowns, extensions, or new builds. If the system slows down, everyone waits.

A City-by-City Breakdown: What’s Happening Where

No two cities are experiencing the housing crunch the same way. The State of the Land 2025 report breaks things down by capital city, and the differences are eye-opening. Some are running hot, others are running out of steam — and a few are just stuck in limbo.

Let’s take a quick lap around the country.

South-East Queensland (SEQ)

Greenfield land is flying off the shelf.

- Lot sales jumped 58% in 2024 — the biggest increase in the country.

- For the first time ever, the median lot price cracked $400,000.

- Land price per square metre is now $992, a jump of 6.7%.

- But while land demand is strong, multi-unit construction is weak.

- The apartment pipeline is thin, and affordability is dropping.

📌 Bottom line: SEQ is hot right now, but under supply in apartments and infrastructure bottlenecks could create problems later.

Greater Sydney

Australia’s most expensive land market is still moving — but carefully.

- Greenfield land sales are up slightly, but still low by historic standards.

- Median lot price? A jaw-dropping $666,670 — up 4% from 2023.

- Apartments? Struggling. New unit sales are 57% below the decade average.

- Supply of medium and high-density dwellings is collapsing.

📌 Bottom line: If you’re trying to buy land in Sydney, be prepared for high prices and limited stock. And don’t expect many new apartments to ease the squeeze.

Greater Melbourne

Melbourne is treading water — not falling behind, but not gaining ground either.

- Land sales are relatively flat, and prices have stabilised.

- Median lot price is around $403,000, with a very slight increase.

- But average lot size is the smallest in the country at just 361 sqm.

- Multi-unit housing? Still stagnant, with very little movement in the pipeline.

📌 Bottom line: Not much growth, but not much momentum either. The market feels stuck.

Perth

Perth is booming — but maybe too fast.

- Land prices jumped 34% — the fastest in Australia.

- Median lot price is now $329,000, and price per sqm sits at $877.

- New land releases are strong, but there’s a risk of demand softening later in 2025.

- Heavy investor activity, especially from the east coast, may be distorting the market.

📌 Bottom line: Perth is in demand now, but affordability could take a hit — and if investor demand drops, the market may cool rapidly.

Adelaide

One of the more stable markets — for now.

- Median lot price rose 19%, but still the lowest nationally at $307,250.

- Land price per sqm increased 6%, now at $788.

- Greenfield supply is tight, and approvals are slow.

- Multi-unit market is almost non-existent — record low unit sales.

📌 Bottom line: Affordable compared to the east coast, but new supply is drying up and planning systems are sluggish.

ACT (Canberra)

A market in serious decline.

- Lot sales have collapsed to just 272 for the year — the worst in 15 years.

- Median lot price fell 4%, but still high at $651,750.

- Greenfield land availability is the worst nationally.

- The multi-unit pipeline is doing better, but is undergoing price correction.

📌 Bottom line: Canberra is dealing with a chronic shortage of new land, while apartment construction is patchy and expensive.

So, What Does This All Mean?

- If you’re in Perth or SEQ, you’re in a hot market — but be careful of overshooting.

- Sydney and Melbourne remain expensive and squeezed.

- Adelaide and the ACT might look better on paper, but they have their own unique issues — mainly around land release and unit supply.

- No city is getting it completely right — and all of them are facing some kind of housing stress.

What the Report Says About Your Chances of Buying or Building

If you’ve been scratching your head wondering whether it’s still worth trying to buy land or build a new home — you’re not alone. This report gives us a sobering, but clear picture of what buyers and builders are really up against.

Let’s break it down.

Buying Land? Be Quick, Be Prepared, Be Realistic

Across most of the country, land prices are up and lot sizes are down. Supply is still playing catch-up, especially in popular growth corridors.

That means:

- Good blocks go fast. If you’re not pre-approved and ready to act, you’ll miss out.

- You might pay more than you planned. Median land prices are rising across most capital cities.

- You’ll probably get a smaller lot. National average is now 411 sqm, and trending lower.

The big risk? Waiting. Some buyers are sitting on the sidelines, hoping for prices to fall. But with land releases still behind pace and infrastructure delivery dragging, that strategy might leave you further behind.

Thinking of Building? Expect Delays and Do Your Homework

Building isn’t just about picking a design and waiting for the slab to go down. The report shows how stretched the industry still is.

- Skilled labour shortages are causing bottlenecks in scheduling.

- Material costs are still high and volatile — don’t expect 2019 prices anytime soon.

- Builder insolvencies are continuing — 3,000 construction companies collapsed in FY24 alone.

Translation: You need to choose your builder wisely, keep cash buffers in place, and expect things to take longer than advertised.

If you’re building in a growth area, be especially cautious. Some estates are seeing delays in civil works and titles being issued — which means your build might not even be allowed to start yet.

Feasibility Is the New Frontier

The report repeatedly refers to “diminishing feasibility.” In plain English? A lot of developers can’t make projects financially viable — so they don’t go ahead.

And when developers stop building, the future pool of available homes shrinks — again tightening supply, pushing prices up, and making it even harder to build affordably.

Multi-Unit Options Aren’t Filling the Gap

If you’re hoping units or townhouses will be a cheaper, quicker way into the market — don’t count on it just yet.

The medium-density sector has basically stalled, thanks to:

- High construction costs

- Planning delays

- Developer hesitation

- Financing constraints

Even “Build-to-Rent” projects, which were supposed to help renters, are few and far between — and usually concentrated in major metro areas.

Strategy Matters More Than Ever

This isn’t a market where you can just roll the dice and hope it works out. Now more than ever, it pays to:

- Research local market trends (not just national averages)

- Get expert help (building consultants, certifiers, independent inspectors)

- Know your rights and responsibilities before you sign anything

- Understand the risks of under-quoting, delays, and builder liquidity

What Needs to Change (And What’s Being Done)

So far, we’ve seen the symptoms: land shortages, rising prices, builder collapses, stalled apartment projects, and long delays.

But what’s actually being done about it — and is it working?

The State of the Land 2025 report doesn’t just paint a shitty picture. It also lays out what needs to happen to fix this mess. Unfortunately, most of it isn’t happening fast enough — and in some cases, not at all.

What Needs to Change (According to the Experts)

The UDIA (Urban Development Institute of Australia) has been waving the red flag on these issues for years. This year’s report pushes the same message again — we need urgent action across six areas:

- Faster land release — governments need to unlock zoned and serviced land sooner, especially in areas with strong demand.

- Planning reform — approval times are still too long and too complex. Councils and state bodies need to stop dragging their feet.

- Infrastructure coordination — too often, housing gets delayed because roads, sewer, and water aren’t delivered on time.

- Incentives for medium-density — if we want to fill the “missing middle” between detached homes and high-rises, we need policies that actually make it viable to build them.

- Builder support — the industry is bleeding skilled trades and small-to-medium builders. Without targeted support, insolvencies will continue.

- Financial feasibility — policies need to address the fact that many projects no longer “stack up.” Lower margins mean fewer new homes, plain and simple.

What Governments Are Doing (And What They’re Not)

The report gives credit where it’s due: the Federal Government’s Housing Accord, the Housing Australia Future Fund (HAFF), and some state-level reforms show that politicians are at least paying attention. There’s a shift toward recognising that housing is national infrastructure, not just a local planning issue.

But there’s a disconnect. While state and federal governments are setting ambitious housing targets, the private sector is expected to deliver 97% of that housing — with very little support to actually get it done.

Planning rules remain inconsistent between jurisdictions. Infrastructure funding is still fragmented. And most importantly, feasibility constraints — the thing choking off supply the hardest — haven’t been seriously addressed.

The Biggest Bottlenecks: It’s Not Demand, It’s Delivery

We’ve said it before, but it’s worth repeating: the biggest issues aren’t lack of buyer demand — it’s the broken delivery pipeline.

Whether it’s:

- Delays in civil works,

- Lack of skilled labour,

- Builder insolvencies,

- Or the fact that developers can’t make medium-density projects work…

…none of this gets solved by just pumping more people into the market or making land artificially cheaper.

Until governments fund infrastructure properly, reform planning approvals, and de-risk development for smaller builders, the housing shortfall is going nowhere.

Final Thoughts: What You Can Do as a Buyer or Builder

After everything we’ve unpacked from the State of the Land 2025 report, one thing’s clear: the housing system is under pressure, and change is moving slowly.

But that doesn’t mean you’re powerless.

Whether you're thinking about buying land, building a new home, or trying to make sense of where the market’s headed, there are steps you can take to make smarter decisions — even in a tight, complex environment.

1. Know Your Market (Not Just the Headlines)

National averages only tell part of the story. Prices, approvals, and supply differ massively by region. A “hot” market in Perth might be cooling by Christmas, while an oversupplied fringe in Melbourne might still take years to recover.

What to do:

Research specific suburbs. Understand local zoning. Look at how fast land is actually titled and how long approvals take in your area.

2. Understand Developer Constraints

Builders and developers aren’t the enemy — but they’re operating in tough conditions too.

- Many can’t get finance.

- Others are stuck in planning limbo.

- And even when they want to build, there may not be enough tradies or materials to get moving.

What to do:

Ask the right questions. Don’t assume advertised time frames are realistic. And always read the fine print on progress payments, price rises, and extension of time clauses.

3. Start Early, Plan for Delays

One of the most common traps? Waiting too long and assuming things will get easier next year. Spoiler: they probably won’t.

- Land might get more expensive.

- Builders might be harder to find.

- Delays might get longer before they get shorter.

What to do:

If you're serious about building, get started now. Speak to a builder. Lock in finance. Understand your timelines — and build buffers into them.

4. Get Independent Advice

Don’t rely solely on what your builder or developer tells you. That’s not a knock on them — it’s just common sense. You’re the one spending hundreds of thousands (or more), so make sure you’ve got someone in your corner.

What to do:

Hire an independent building consultant, certifier, or advisor who can help you review contracts, inspect works, and keep things on track.

Final Word

The housing market might feel overwhelming, but information is power. The more you understand how things work — and why they’re not working — the better you’ll navigate it.

You don’t need to wait for the government to “fix it” before making your move. But you do need to go in with your eyes open.

Frequently Asked Questions

1. Is now a good time to buy land or should I wait?

There’s no perfect time, but the data suggests prices are still rising in most markets. Waiting might not bring relief — and could mean paying more later. If you're financially ready, buying sooner with a good plan may be smarter than sitting out.

2. Why are land prices going up when construction is slowing down?

Because land is limited and demand is still high. Even though fewer homes are being built, the number of people needing housing keeps growing — and that drives up prices for whatever land is available.

3. Are apartments a more affordable option right now?

In theory, yes — but in practice, apartment construction is stalling. The number of new units being built is at a decade low, which limits your options and may keep prices higher than you’d expect, especially in inner city areas.

4. What’s causing so many builder insolvencies?

Rising material costs, labour shortages, fixed-price contracts with no room for variation, and cash flow issues. Many builders are operating on razor-thin margins and can’t absorb cost blowouts.

5. How can I protect myself from delays or cost increases when building?

Start by understanding your contract. Allow for contingency in your budget. Choose reputable builders with strong financials, and always get independent advice before signing.

6. Is the government doing anything to fix the housing shortage?

Yes — but progress is slow. Programs like the Housing Accord and HAFF aim to boost supply, but most of the actual delivery is still up to private developers. Bottlenecks in planning, labour, and feasibility remain unresolved.

7. What does ‘feasibility’ mean in property development?

It’s whether a project makes financial sense to build. If the cost to deliver a home is higher than what people will pay for it, the project doesn’t “stack up” — and won’t go ahead. That’s a major reason new housing isn’t being built.

8. Why are lot sizes getting smaller?

To make land more “affordable” per block, developers are reducing the size of each lot. It’s one way to manage costs in a market where land prices and infrastructure charges are rising.

9. What can I do if I’m priced out of the area I want?

Look at up-and-coming suburbs or regional centres with better infrastructure delivery. Be open to alternative building types (like dual occupancy) and check for government grants or schemes in your state.

10. What’s the risk of waiting for a better deal?

In a market with limited supply and growing demand, waiting might mean you pay more later — or miss out altogether. If you’re ready to buy or build now, delaying can cost you time, money, and opportunity.

Further Reading