You've come to the right place to learn all about residential construction and quality management. Before we forget, if someone forward you this newsletter, don't forget to subscribe to our newsletter to gain access to our resources and the occasional email update.

📰 Interesting News Articles From This Week

Australia's treatment of housing as a primary investment vehicle and store of wealth increasingly shapes policy, which often tilts toward protecting home prices over solving affordability.

Recent news & data confirms housing's outsized role in driving and widening inequality, with the wealth gap between homeowners and renters reaching a historic high. This occurs against a backdrop of sharp price gains over the past five years.

This investment landscape continues to attract major Japanese players hunting for returns and stable supply chains through acquisitions of local builders. The NEX Building Group is now 80% owned by Asahi Kasei Homes, a member of the Japanese Asahi Kasei Group. Similarly, Sumitomo Forestry acquired a 51% majority stake in Metricon, Australia's largest home builder, in late 2024.

These moves follow other significant plays, such as Kajima's roll-up of Icon and Cockram and Daiwa House's push into build-to-rent with Lendlease.

With many stalwart building company founders retiring, expect this acquisition trend to continue as second-generation management looks to realise value.

The challenge for any new owner will be to retain the founder's edge—that disciplined focus on design, build quality/quality management, building science integration (building envelope, air tightness, air quality) and genuine customer focus—to avoid these businesses blurring into a sea of sameness. It is on this point that long-term advantage will be won or lost.

🤔 From Exits to Endurance: Building Australia's Next Chapter

We're seeing a wave of successful exits from cashed-up company founders and private equity groups. The question is, what comes next? The answer lies not just in celebrating these wins, but in actively stimulating the next generation of innovation.

We need to nurture and grow our homegrown potential through targeted government co-sponsorship and by building a true environment for growth.

Shifting the Investment Focus

Our current investment landscape feels upside down. With superannuation funds holding $4.7 trillion in assets and housing stock now valued at $11.5 trillion, in 2024 tech companies raised $4 billion with approx $20 blllion VC assets under management, we must ask if this capital is being deployed to build our future.

Between super fund controversies and the volatility of crypto, it's clear we need to redirect attention. If the government is serious about new taxes on large super balances, it should be equally serious about stopping the relentless focus on housing as the primary asset class. Our national priority must be to channel investment into innovation and technology.

The resources boom is peaking. Without solid investment in innovation now, Australia risks missing the boat entirely. We learned from the manufacturing exodus that outsourcing core capabilities has long-term consequences. This doesn't mean we can't build new, complementary strengths in advanced sectors that support a modern economy.

Learning from Global Lessons

China provides a compelling case study in long-term strategy. They have invested heavily in infrastructure and renewables not for ideological reasons, but as a strategic move to achieve energy independence and reduce their reliance on resources from countries like Australia. This is a very smart play.

So, how is Australia responding to this shift? Are we building our own strategic independence? Too often, it seems we are simply consolidating our housing stock and selling it off via build-to-rent projects and foreign investors—effectively becoming a nation of renters in our own country.

A Blueprint for Our Strengths

The solution requires a disciplined, introspective approach. As Peter Drucker outlines in his essential book, Managing Oneself (a highly recommended 60-page read), "one cannot build performance on weakness." We must identify our unique strengths as a nation and double down on them.

I saw this principle in action during my time in Silicon Valley. The magic there isn't a secret formula; it's a cohesive ecosystem where early-stage companies get support from lawyers, accountants, and investors—often deferring payment for equity.

This model de-risks the initial leap and aligns everyone towards success. This is not hard to recreate, but it does require government intervention to encourage and de-risk investment in this sector.

A tonne of startups will fail, and that's a feature, not a bug. But the greater risk is doing nothing. At a time when resource revenues are set to decline, the cost of failing to encourage innovation is an existential issue we can no longer afford to ignore.

🤗 Howdy Readers

In this newsletter, you'll find:

📬️ Post 1 - The Hidden Systems That Make a Building Work 😲

Ever wondered what's really going on inside the walls of a comfortable, safe building? 🤔 It all comes down to MEP—the Mechanical, Electrical, and Plumbing systems.

Think of MEP as the building's nervous system, silently managing everything from the air you breathe to the lights and water you use.

Getting these systems right is helpful in saving money, improving energy efficiency, and ensuring your home is safe and functional.

Getting them wrong can lead to costly fixes and a whole lot of headaches. Ready to demystify the magic behind modern buildings?

👉️ Read on to see how MEP is the unsung hero of any great construction project.

📬️ Post 2 - The 90s Policy That Still Shapes Your Home Today🧐

Ever wonder why you can choose your electricity retailer but not who owns the power lines?

It all stems from a major 1990s reform called the Hilmer Report, which reshaped competition across our entire economy.

This policy affects you as a homeowner more than you might think. It's the reason behind the push for more choice in services, the rules that prevent unfair pricing for things like utility connections, and why your local council can't just undercut private builders.

At the report heart, the goal was to encourage efficiency and fair play, so businesses—both public and private—compete on a level playing field. The idea was that effective competition should be the default, leading to better prices, more innovation, and higher quality services for everyone.

While it helped fuel a period of strong economic growth, the rapid changes also sparked plenty of public debate at the time.

👉 Click to learn more about the six key "levers" of this policy and how they directly impact the cost, timing, and quality of your home build or renovation!

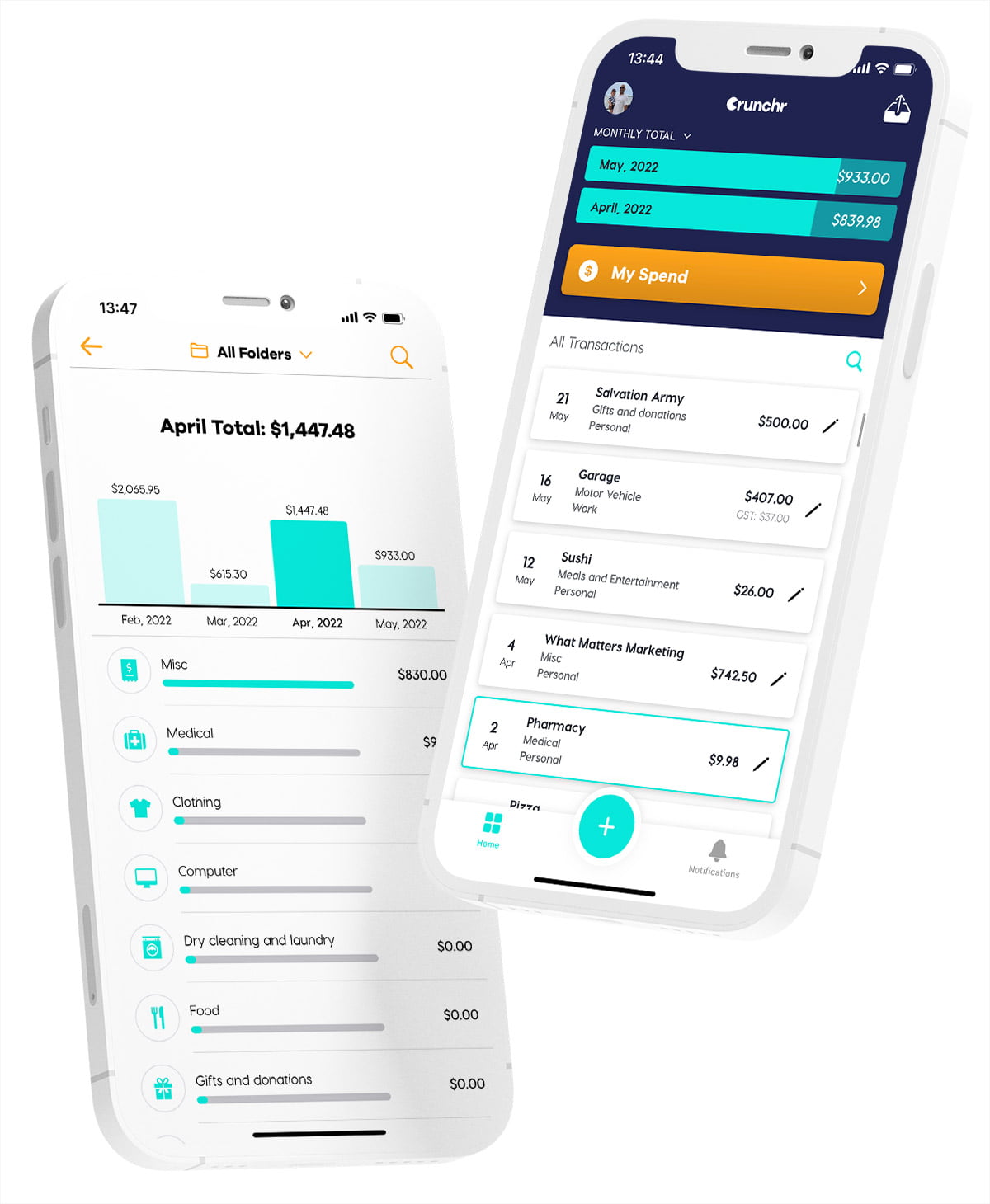

🔒 Software of the Week: Crunchr

(This isn’t a sponsored post—just software we recently started using and thought we’d share it with you.)

Ever feel like your business expenses are scattered across different cards, apps, and crumpled receipts between your seats, glove box (yep, i have gloves in mine) or floor mats?

This week, we’re shining a light on Crunchr, a simple and easy to use new tool designed to gather all that financial chaos into one simple, organised place.

Crunchr is an expense tracking app. It’s a dedicated home for all your business spending, where you can easily log purchases, track what you’ve spent against your budget, and get everything perfectly sorted for tax time.

So, who benefits most? If you're a freelancer, sole trader, or run a small business, this app is a handy. It solves the major headache of manually sorting through expenses at the end of the quarter, saving you from a last-minute scramble and potential errors.

The app is incredibly easy to use, which saves you time and mental energy. By keeping your expenses organised throughout the year, it dramatically reduces the complexity of your bookkeeping.

The best part? It seamlessly prepares your data for a smooth export directly into your preferred accounting software, like Xero or MYOB.

Crunchr is an android or IOS application. It operates on a subscription model - runs at $6.99/month, ATO compliant, and it's known for being very affordable, especially for the value it provides.

Why we like it: It’s the perfect blend of user-friendly and powerful. On top of being easy and affordable, it’s a homegrown Aussie startup. Paying for your subscription in AUD (not USD) means you’re supporting local innovation without getting stung by foreign currency fees/exchange rates (plus your helping stop brain drain overseas - as long as they dont relocate to the USA to chase Venture Funding).

👉 Ready to simplify your expense tracking? Click through to explore Crunchr firsthand and see how it can work for you!

📹️ Featured Youtube Channel of The Week

Business Reform - John Padfield

No fluff, no bull—just good information from a measured perspective

🛍️ Ad Of The Week

"The Gobbledock" - Smith's Chips (1987)

Can't see the video embed below? Click here. to watch on Youtube.

🎧️ Music of the week

"The Power" - Snap (1990)

Can't see the video embed below? Click here. to watch on Youtube.

✅ Our Quality Checklists

C14 Tile Design & Installation Checklist recently added to the list 09-08-2025

Please note: You’ll need to be a member and to log in to access the content.

📜 Reader Survey: Should all builders display a quality rating score?

Tell us what you think. Can't see the embed below? Click here to open it (opens builder quality score rating survey)

Member discussion